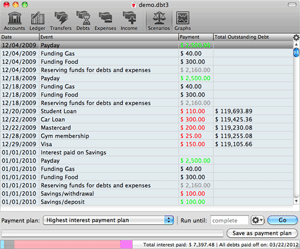

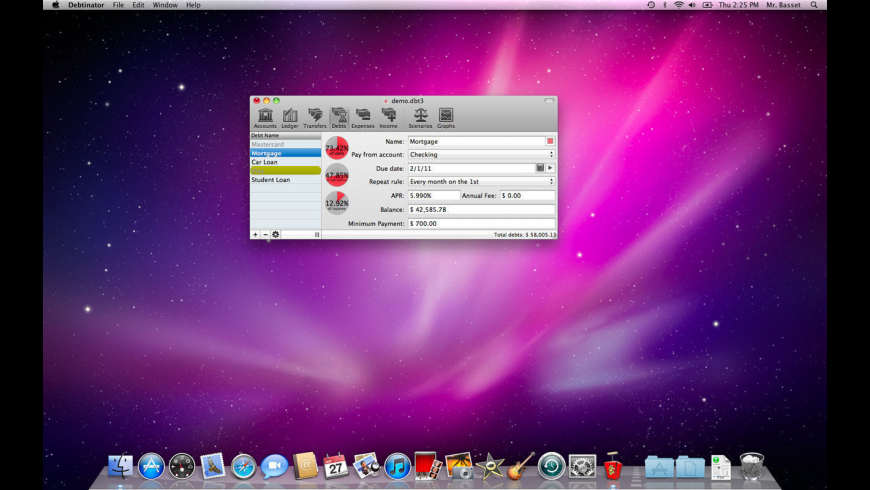

You did remember that you have to pay your car insurance every 6 months when you guessed you could send an extra $20, right? Debtinator remembered.Īnd the best part is - it works within your lifestyle. And the month after that, you can't send anything extra because your car insurance payment is due. But maybe next month you could actually send $50. Sure, maybe you can spare $20 to your credit card this month. It analyzes all of this and figures out just how much money you really have available to send to your debts. So you tell it your income, your recurring expenses, and describe your debt load. Instead of relying upon you to guess how much money you can send, you instead describe your financial situation and it figures out how much money you have available to send for you. Because if you were wrong, then all those projections are bogus.ĭebtinator is more intelligent. "Hmm, I think I can spare another $20 to my credit card this month." And then you make projections based on your guess and just hope and hope that you guessed right.

Because when it comes down to it, you're still just guessing. And that's awesome! But you can do better. Some plans or applications tell you to just send a little bit more to your debts and wach them melt away. Especially with this economy being as unpredictable as it is, it's not a good time to have a high debt load.īut it's not nearly as easy getting out of it as it was into it. ¿Qué hace Debtinator De? Get your debt under control the right way.Įverybody that has debt knows they should get rid of it - it's crippling and can overwhelm and consume your life. Feature requests? Problems? Bugs? Contact us and let us know! We hate bugs in the app even more than you do - it's handling your money and our reputation, and it's gotta be flawless.ĩ. And the month after that, you can't send anything extra because your car insurance payment is due.Ĩ.

Some plans or applications tell you to just send a little bit more to your debts and wach them melt away.ħ. It analyzes all of this and figures out just how much money you really have available to send to your debts.Ħ. "Hmm, I think I can spare another $20 to my credit card this month." And then you make projections based on your guess and just hope and hope that you guessed right.ĥ. Or go the other way - maybe budgeting $75/month for eating out will only keep you in debt for another 3 months and cost you a couple hundred bucks more.Ĥ. Instead of relying upon you to guess how much money you can send, you instead describe your financial situation and it figures out how much money you have available to send for you.ģ. You did remember that you have to pay your car insurance every 6 months when you guessed you could send an extra $20, right? Debtinator remembered.Ģ.

0 kommentar(er)

0 kommentar(er)